How to apply for a Back to Back Preferential Certificate of Origin

How to apply for back-to-back preferential Certificate of Origin with Singapore Customs?

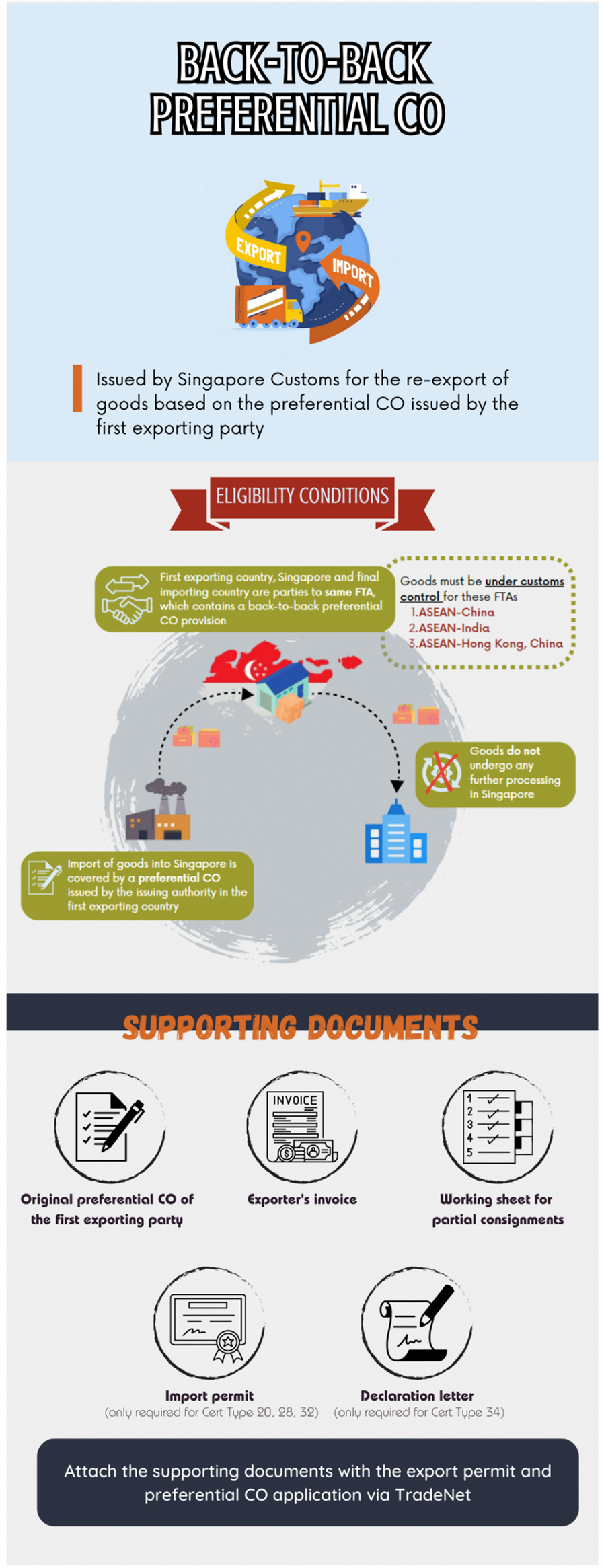

The back-to-back preferential CO is issued by Singapore Customs for the re-export of goods based on the preferential CO issued by the first exporting party. The goods must be imported into Singapore and meet the conditions for it to be issued.

In general, the re-export may be eligible for a back-to-back preferential CO issued under a specific Free Trade Agreement (FTA), under the following conditions:

-

The FTA Contains a back-to-back preferential CO provision;

-

The first exporting country, Singapore, and the final importing country are Parties to the same FTA;

-

The goods are imported into Singapore from the first exporting country and re-exported from Singapore to the final importing country;

-

The import of the goods into Singapore is covered by a preferential CO issued by the issuing authority in the first exporting country;

-

The goods do not undergo any further processing in Singapore; and

-

The goods fulfill the relevant requirements in the Operational Certification Procedures of the FTA.

Please refer to the legal text of the respective Free Trade Agreements for the eligibility requirements for back-to-back preferential CO application.

| Certificate Type | Back-to-Back Preferential CO |

|---|---|

| 17 | Back-to-Back AFTA ATIGA Form D |

| 20 | Back-to-Back ACFTA Form E (also known as Movement Certificate) |

| 22 | Back-to-Back AKFTA Form AK |

| 26 | Back-to-Back AJCEP Form AJ |

| 28 | Back-to-Back AIFTA Form AI |

| 30 | Back-to-Back AANZFTA Form AANZ |

| 32 | Back-to-Back AHKFTA Form AHK |

| 34 | Back-to-Back RCEP Form RCEP |

The required supporting documents include:

-

Original preferential CO of the first exporting party

-

Exporter’s invoice

-

Import permit (required only for application of Certificate Types 20, 28 and 32)

-

Declaration Letter (required only for application of Certificate Type 34)

You can attach the supporting documents with the export permit and preferential CO application via TradeNet.

For back-to-back Form Ds, you may refer to an e-ATIGA Form D reference number issued by the first exporting party instead of providing the hardcopy Form D, if:

-

The goods originate from Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Thailand and Vietnam; and

-

The e-ATIGA Form D from the ASEAN Member States has been successfully received.

You may refer to Electronic Exchange of Form D via the ASEAN Single Window for more information.