Permit Application Procedures

Permit Application Procedures

An importer may be granted Goods and Services Tax relief on the re-importation of goods meant for commercial and personal use, which are temporarily exported for qualifying purposes (e.g. for repair) subject to certain conditions.

To qualify, a temporary export permit is required to be obtained prior to the temporary export of the goods for the qualifying purpose (e.g. for repair).

Individuals may engage a local freight forwarding agent to declare the temporary export and re-import permit on their behalf and will be required to submit the relevant support documents during the permit application.

Please refer to the list of local freight forwarding agents.

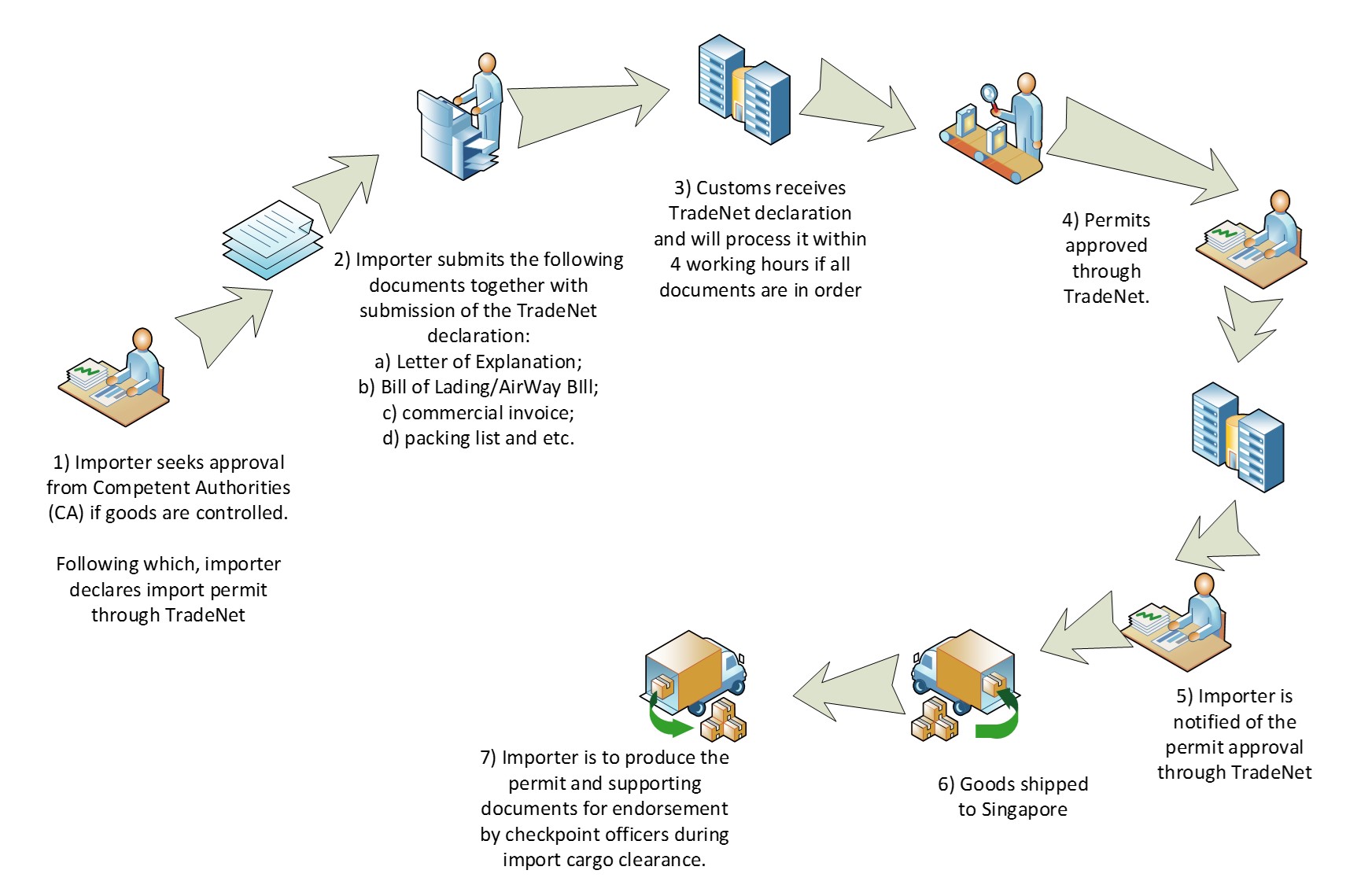

Traders should follow these procedures to apply for permits for temporary export:

-

Seek approval from the relevant Competent Authority (CA) if you are temporarily exporting controlled goods.

-

Apply for a Customs Out (Temporary Consignment - TCI) permit via TradeNet before the actual export.

-

Submit the following documents together with your submission of the TradeNet declaration:

-

Cover letter stating:

-

Purpose for temporary export

-

Duration of temporary export

-

-

Commercial invoice

-

Packing list

-

Any other documents as specified by Singapore Customs

-

-

Produce the permit and supporting documents for endorsement by checkpoint officers during export cargo clearance.

-

Before the re-importation of the goods, apply for a corresponding Customs In-Non-Payment (TCI) permit* through Tradenet. The previous Out (Temporary Consignment) permit number must be declared in the "Previous Permit No." field. *For motor vehicles that are were temporarily exported, a Customs In-Non Payment (GTR) permit, with place of receipt indicated as "VEHSG", should be declared instead.

-

Produce the permit and supporting documents for endorsement by checkpoint officers for clearance during cargo re-import.

-

Please also take note of additional requirements for temporary exports.