Declaring Agent Account

Declaring Agent Account

Application / Renewal Process

‘Key Personnel’ refers to an individual whose particulars are registered with the Accounting and Corporate Regulatory Authority (ACRA) for the purpose of registering a business entity; or the relevant Issuance Agency of the Unique Entity Number (UEN) for the purpose of applying for a UEN.

‘Authorised Personnel’ refers to an individual authorised by an entity’s Key Personnel to help manage the entity’s Customs Account and/or DA Account including Declarant details.

The Key Personnel or Authorised Personnel of a DA can log in to apply for or renew the DA Account. Singapore Customs will inform the Key Personnel of the application outcome and the validity period of the DA Account. The processing of the application takes three working days, upon receipt of complete supporting documents for straightforward cases while complex cases might take longer to review.

All DAs are required to maintain a valid Inter-bank GIRO (IBG) with Singapore Customs to make the payment of duties,taxes, fees, penalties and other charges on services offered by Singapore Customs from your bank account to Singapore Customs directly. The IBG application usually requires 3 to 4 weeks for the bank’s approval. The IBG application procedures can be found here.

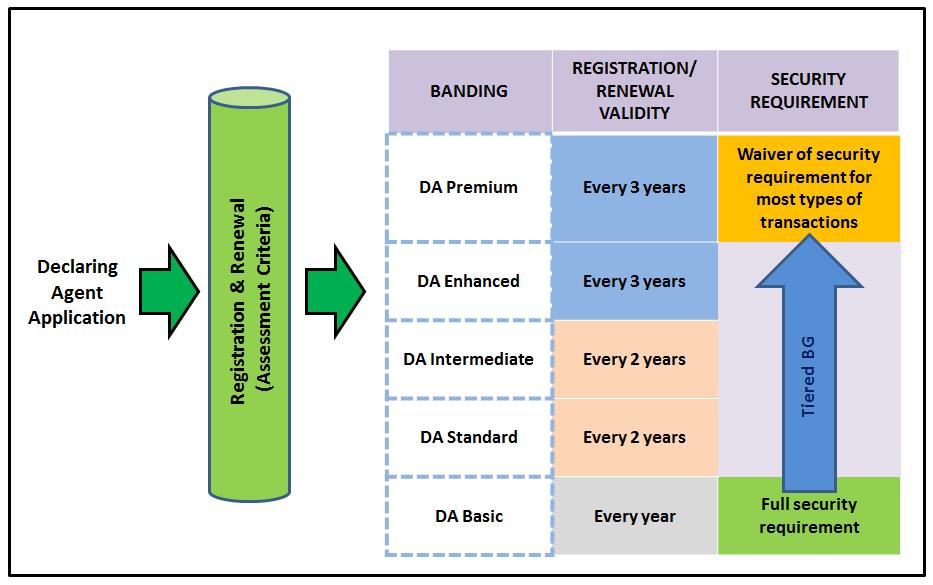

Depending on your DA Account registration validity, you are required to renew your DA Account every 1, 2 or 3 years. The entity’s Key Personnel and Primary Contact Person will receive a reminder at least 1 month before the expiry date to renew the account.

Update / Termination Process

Existing DAs that wish to update their particulars and contact details in the DA Account or terminate their DA Account if they do not wish to be a DA can log in to update or terminate their DA Accounts. Please note upon termination, all the existing Declarants and their TradeNet IDs registered under the DA Accounts will be terminated accordingly.

Assessment Criteria

When applying for or renewing a DA Account, you will be assessed based on the assessment criteria under the DA Governance Framework illustrated below.

A DA must minimally possess the basic qualities (shown in red in the illustration) and should take pro-active steps to ensure compliance if they have self-assessed to be lacking in those areas. The desirable qualities (shown in black) are areas that DAs should also ideally achieve.

When going through the checklist, DAs should answer “Yes” if they are able to fulfil and demonstrate the described requirement; or “No” if they are not able to fulfil, or can only partially fulfil the requirement.

The assessment criteria are not prescriptive and allow DAs the flexibility to be in accordance to the framework according to their business operations. You can read through the Assessment Criteria Guide to better understand the assessment criteria.

Singapore Customs will conduct selective validation checks at a DA’s premises. We may also request the company to submit its internal control procedures and processes when necessary.

Assessment Results

The final assessment score will translate into one of the 5 bandings shown in the diagram below. In general, the validity or renewal period can range from 1 year to 3 years, and the security requirement can range from a 100% requirement to a waiver of the requirement for most types of transactions.

Exemptions

If you are under the TradeFIRST framework, you will be exempted from the DA Governance Framework assessment. However, you are still required to apply for a DA Account if you wish to submit permit applications via TradeNet. Your DA Account validity and benefits will correspond with your TradeFIRST banding.