Understanding HS Classification

Understanding HS Classification

The information in this section aims to provide some background of HS classification and the possible ways to build up your capability in HS classification.

.png)

What is the Harmonised System (HS)?

The Harmonised Commodity Description and Coding System, or simply the HS, is an international nomenclature (at 6-digit level) developed by the World Customs Organisation (WCO) for the classification of goods.

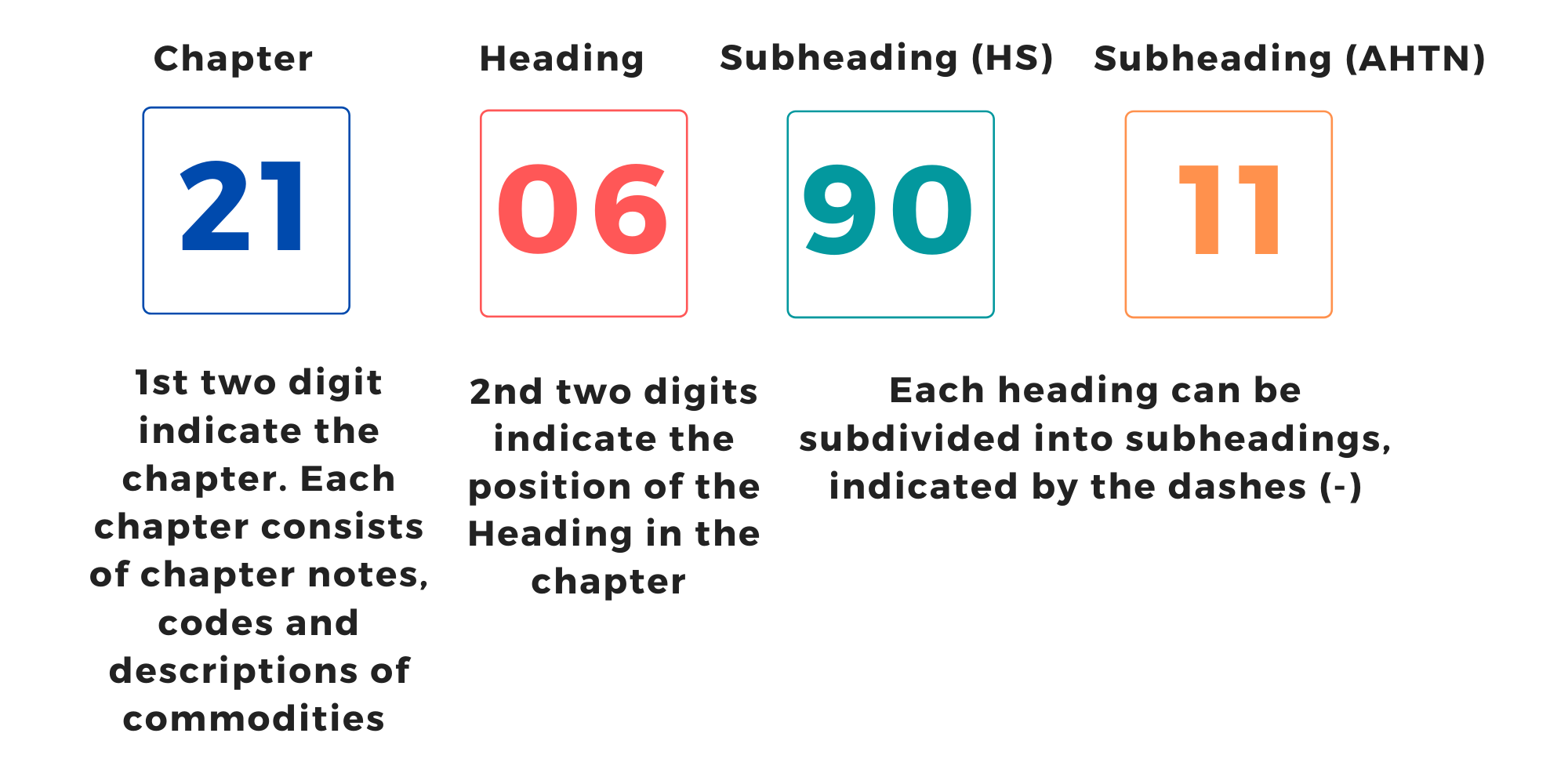

Structure of the Harmonised System (HS)

The HS comprises 21 Sections covering 97 Chapters. It consists of:

- Section and Chapter Notes, including subheading notes

- A list of headings arranged in systematic order, divided into subheadings, where appropriate

- General Interpretative Rules (GIR)

The goods in the HS are arranged in order of their degree of manufacture. The same order is arranged within each Chapter and its headings.

Process of Classification

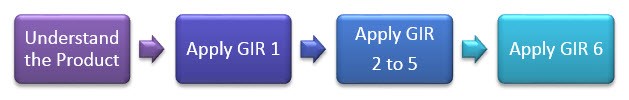

In every case, the goods must first be classified in the appropriate 4-digit HS heading, followed by the appropriate 1-dash subheading, and the appropriate 2-dash subheading and so on. You should not proceed directly to the lower-level subheadings without first determining the appropriate heading.

When classifying your products, one will need to apply the General Interpretative Rules (GIR) which provide a step-by-step basis for the classification of goods and to ensure uniform interpretation of the Harmonised System (HS) nomenclature. (Note: GIR must be applied in sequential order).

ASEAN Harmonised Tariff Nomenclature (AHTN)

The ASEAN Harmonised Tariff Nomenclature (AHTN) is an 8-digit HS nomenclature used by all ASEAN Member States (AMS). The AHTN facilitates trade among AMS through consistent and uniform interpretation in the classification of goods. It is based on the 6-digit Harmonised Commodity Description and Coding System Nomenclature developed by WCO.

The last amendment to AHTN was done in 2022 where all 351 sets of 2022 amendments to the WCO’s HS nomenclature was incorporated. The latest tariff schedule is available in Singapore Trade Classification, Customs and Excise Duties (STCCED) 2022. You may refer to the highlights on key amendments.

Course and Self-Learning Resources

SC102 - Classification and the Harmonised System Course

If you wish to pick up basic skills on the Harmonised System (HS) classification of goods, you may register for our SC 102 - Classification and the Harmonised System course, which provides a better understanding on the classification of goods and the HS.

Handy Guides on HS Classification

Download handy guide on How to determine HS code.

Download handy guide on How to read the HS.

E-learning Modules

If you wish to learn classification of products from across more than 30 HS Chapters, try our Multiple Choice Questions (MCQs). Categories in the MCQ questions includes products ranging from food and beverages to chemical preparations to plastic articles, and machines. Please click on this link for answers and classification rationale.