TradeFIRST

What is it?

TradeFIRST stands for Trade Facilitation & Integrated Risk-based System. It is an integrated assessment framework that provides a holistic assessment of a company and determines the level of facilitation accorded.

The assessment is free and it is mandatory for all companies who wish to apply for a Singapore Customs scheme or licence.

Participation in ASEAN Customs Transit System (ACTS) would be awarded additional points under the TradeFIRST assessment from 01 Jan 2023 onwards. Please refer to the TradeFIRST Self-Assessment Checklist “B. Participation in ASW” for more information.

Benefits of TradeFIRST

Greater Facilitation

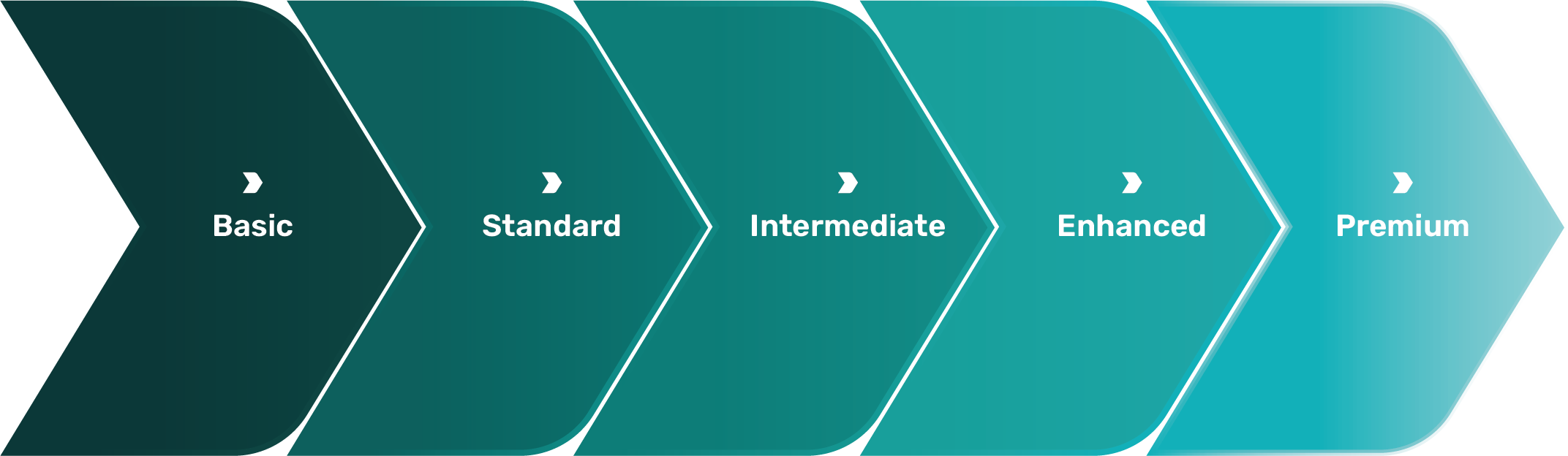

We adopt a risk management approach to classify the level of facilitation into 5 bands - Basic, Standard, Intermediate, Enhanced and Premium.

The higher your TradeFIRST band, the greater the facilitation accorded to you.

For example, a company that obtains a Premium band can enjoy the facilitation and schemes accorded to the Premium band and the ones below it (in this case, Basic to Premium).

This list shows the various Customs facilitation and schemes under each TradeFIRST band.

-

Basic Band

-

Standard Band

- Licensed Warehouse Scheme Type I

- Zero-GST Warehouse Scheme Type I

- Microbrewery

- Compressed Natural Gas Station

-

Intermediate Band

-

Enhanced Band

-

Premium Band

- Reduced container sealing

- Waiver of post-importation documentation checks

- Secure Trade Partnership Plus

- APEX Licence

- Consolidated Declaration

- Bonded Truck Scheme

Terms and Conditions for the use of TradeFIRST Logo

TradeFIRST Assessment

There are 6 sections under the TradeFIRST assessment framework:

1) Company Profile

- Corporate policies

- Financial background

2) Procedures and Processes

- Management of information and records

- Management of personnel, including training

3) Security

- Business partnering and customer screening

- Security risk assessment and incident management

- Business continuity

- Security of cargo, containers and conveyance

- Premises security and access control

4) Inventory Management

- Capability of inventory system to track and trace movement of goods, and to flag out discrepancies

5) Other Scheme-Specific Requirements

- Specific requirements applicable to applicants of certain Customs schemes, such as the Strategic Trade Scheme Bulk Permit

6) Compliance

- Company’s compliance records

To view the entire TradeFIRST assessment criteria, you may download the checklist.

The TradeFIRST assessment process is shown in the following table:

| Step 1 | The company receives the TradeFIRST Self-Assessment Checklist from Customs, with detailed information on the assessment framework, for the company’s self-assessment. |

| Step 2 | Company fills up the TradeFIRST Self-Assessment Checklist and sends it to Customs with the relevant supporting documents. |

| Step 3 | On-site assessment will be scheduled and conducted, upon receipt of relevant supporting documents. |

| Step 4 | The company receives its application outcome, the band it is placed in that determines the facilitation and schemes the company can enjoy, and the areas for improvement (if any). |

Note: The TradeFIRST Self-Assessment Checklist would be used to assess all new (for new applicants), renewal (for existing licensees) and supplementary applications. The assessment would generally take about 3 to 4 months to process, upon complete submission of relevant documents. It may take longer for more complex cases.

Note: The TradeFIRST Self-Assessment Checklist would be used to assess all new (for new applicants), renewal (for existing licensees) and supplementary applications. The assessment would generally take about 3 to 4 months to process, upon complete submission of relevant documents. It may take longer for more complex cases.

Renewal

For any Customs scheme applied successfully, your company will be subject to reviews and renewals, depending on the band accorded:

| Band | Renewal |

|---|---|

| Premium | Once in 3 Years |

| Enhanced | Once in 3 Years |

| Intermediate | Once in 2 Years |

| Standard | Once in 2 Years |

During the renewal process, your company is required to submit the TradeFIRST Self-Assessment Checklist and all relevant supporting documents, and undergo the on-site assessment again.

Reviews may also be conducted at shorter intervals under special circumstances, such as for companies with areas identified for improvement, within a stipulated time period.

If you require further assistance on TradeFIRST, please email customs_schemes@customs.gov.sg.

Frequently Asked Questions (FAQs)

This section guides companies who wish to perform a TradeFIRST self-assessment under specific business operations mentioned below.

Companies with Multiple Sites and/or Multiple Schemes

There will only be one assessment for the company regardless of the number of schemes it applies for. Therefore, the self-assessment checklist should be filled in relation to all of the company’s operating sites and relevant to the schemes that the company is applying for.

All of its operating sites must be declared in the checklist:

- Indicate “Yes” if the company meets the criteria for all sites. It is mandatory to attach all relevant supporting documents.

- Indicate “No” if none or only some of the sites meet the criteria. Indicate the name of the site(s) which meet the criteria in the “Remarks” column.

Note: As a prerequisite, the company must fulfil all the mandatory criteria for all the operating sites.

Outsourced Functions

The company should not indicate “N.A.” on outsourced functions, for example using third party logistics providers. It should indicate if its business partners’ procedures meet the criteria based on its service level agreements and contractual obligations.

Companies with Global or Regional Offices

TradeFIRST assessment is only applicable to the company’s procedures conducted on its operating sites in Singapore. For example, comments on pre-employment verification criteria must pertain to Singapore’s procedures and not the company’s regional or global practices.