Classifying My Products

Overview

New Traders And Registration Services

Importing Goods

Overview

Controlled & Prohibited Goods for Import

Overlanded and Shortlanded Goods

Import procedures

Temporary Import Scheme

Importing Dutiable Motor Vehicles

Exporting Goods

Transhipping Goods

National Single Window

ASEAN Customs Transit System (ACTS)

International Connectivity

Valuation, Duties, Taxes & Fees

Overview

Establishing Customs Value for Imports

Duties and Dutiable Goods

Goods and Services Tax (GST)

Refund of Duties & GST

Application for Customs Ruling on Valuation

Permits, Documentation and Other Fees

Singapore Duty-Paid Cigarette (SDPC) Mark

E-learning Resources

Harmonised System (HS) Classification of Goods

Understanding HS Classification

Find my Harmonised System Code

Classifying My Products

Application for Customs Ruling on Classification of Goods

Certificates of Origin

Overview

Claiming Preferential Tariff Treatment for Dutiable Imports

Application for Customs Ruling on Origin Determination of Goods

Customs' Schemes, Licences & Framework

Overview

TradeFIRST

Air Store Bond Scheme

Apex Licence

Bonded Truck Scheme

Cargo Agent's Import Authorisation Scheme

Chemical Weapons Convention (CWC) Licence

Consolidated Declaration

Container Freight Warehouse Licence

Duty Free Shop Scheme

Excise Factory Scheme

Industrial Exemption Factory Scheme

Kimberley Process Certification Scheme

Licensed Warehouse Scheme

Petroleum and Biodiesel Blends Licences

Secure Trade Partnership (STP) & STP-Plus

Strategic Trade Scheme Bulk Permit: Export, Transhipment and Transit

Zero-GST Warehouse Scheme

IRAS Scheme

Free Trade Zone Operator Licence

Trade Security In Singapore

Strategic Goods Control

Overview

Strategic Goods Control List

Permit and Registration Requirements

Import Certificate and Delivery Verification

Sanctioned Lists and Red Flags

Courses & Events

Resources

Useful Links

Chemical Weapons Convention (CWC)

Introduction

Announcement

Legislation

Controlled Chemicals

Licensing Requirements

Importing of NA(CWC) Controlled Items

Exporting of NA(CWC) Controlled Items

Declarations

Inspections

Offences

Glossary

Useful Links

United Nations Security Council Sanctions

Border Enforcement of Intellectual Property Rights

Compliance

Overview

Self-Compliance

Customs Compliance Toolkit

e-Learning for Handling of LCL Consolidated Cargoes

Post-Clearance Audit

Offences & Penalties

Voluntary Disclosure Programme

Acts and Subsidiary Legislation

Overview

Customs Act

Goods and Services Tax

Regulation of Imports and Exports Act

Free Trade Zones Act

Strategic Goods (Control) Act

Chemical Weapons (Prohibition) Act

Business Resources

Classifying my products

Classifying your product - All you need to know

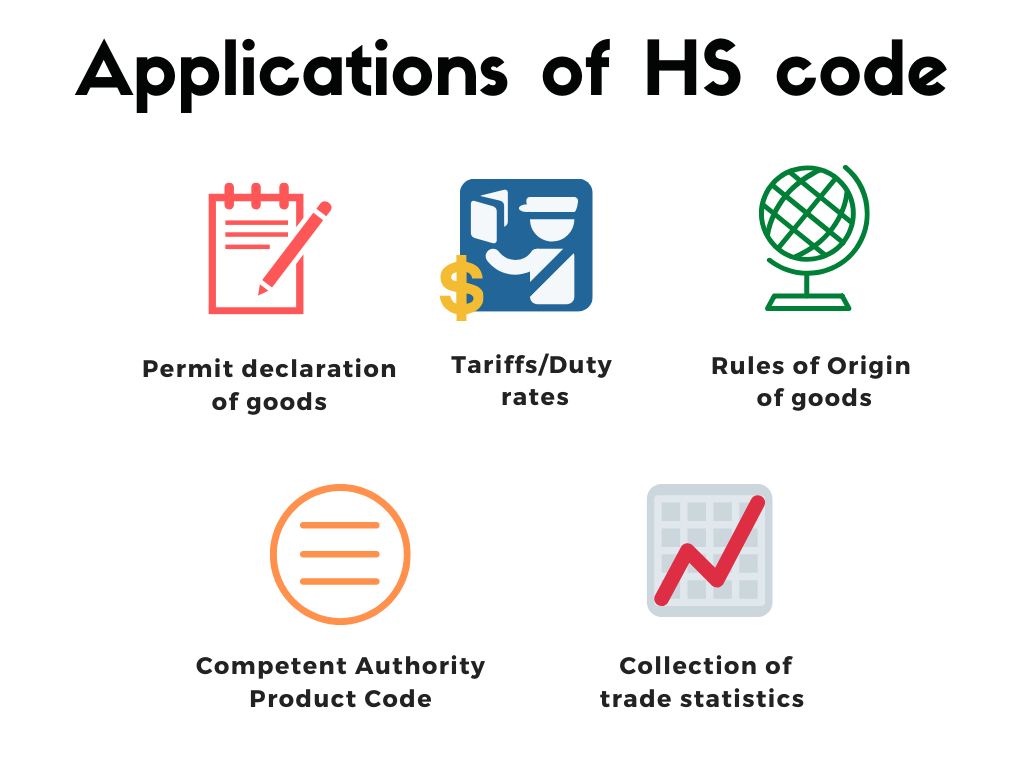

The Harmonised System (HS) codes of goods is internationally harmonized at the 6-digit level (e.g.2203.00). In Singapore, the HS code of goods is harmonised across all ASEAN member countries at the 8-digit level (e.g. 2203.00.11).

Handy Guides

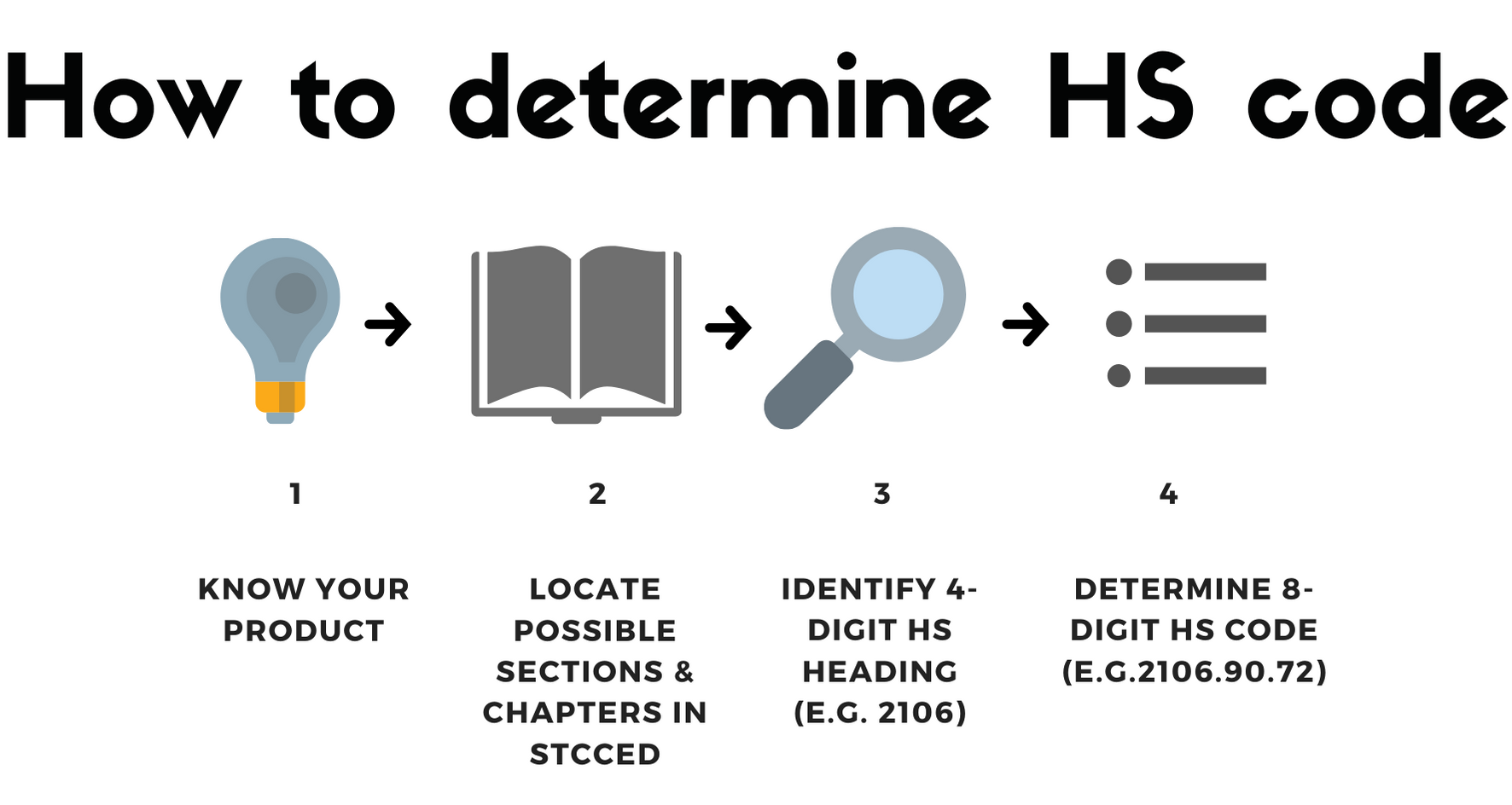

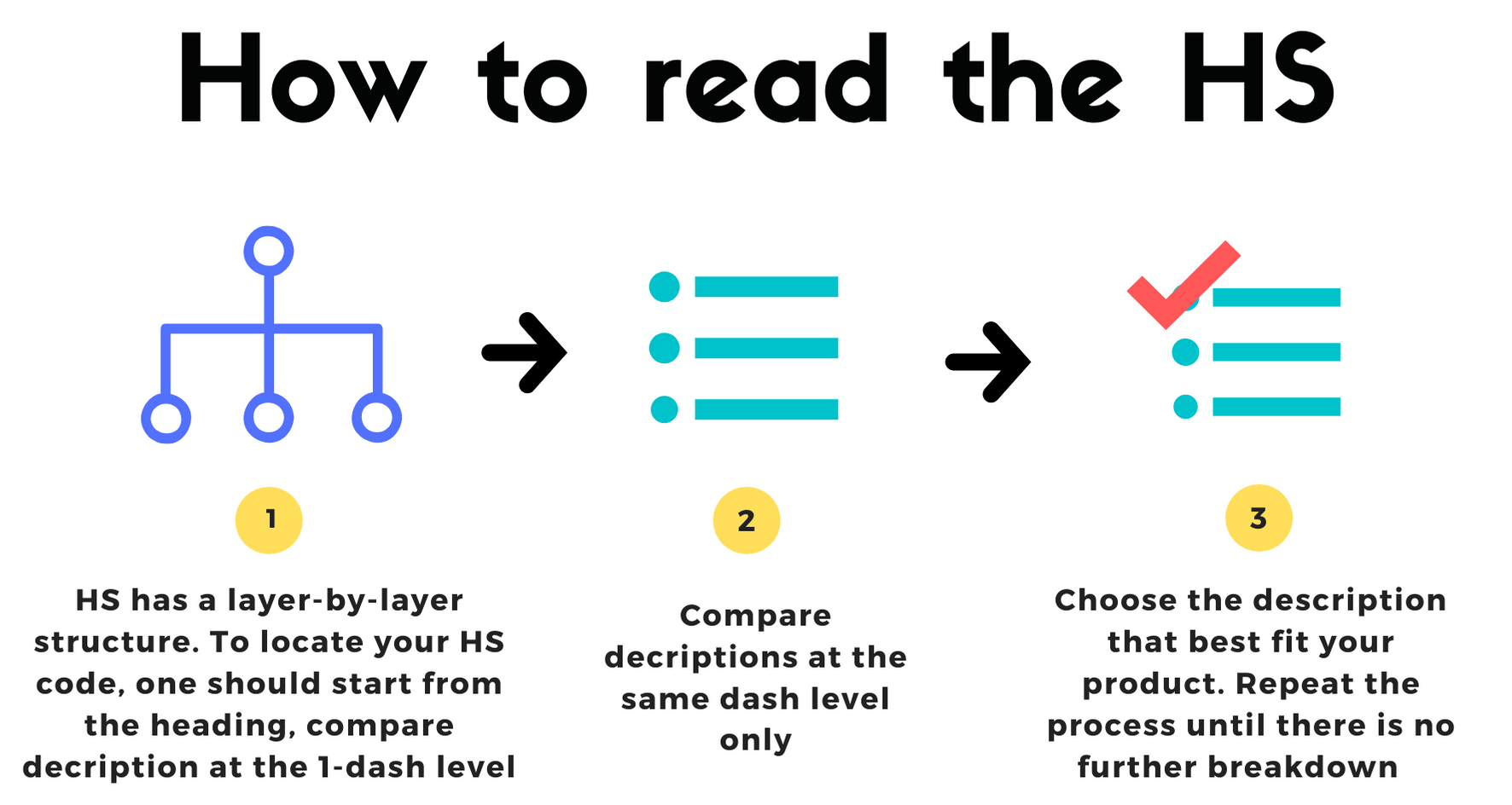

Classification is the process of finding the most specific description in the HS. To do so, you may refer to the following infographics to understand how to identify and read the HS in the Singapore Trade Classification, Customs & Excise Duties (STCCED).

A guidebook to classify chemicals and chemical products is also available to help you in classifying products in this category.

Click here to see an example on how to determine your HS code.

Click here to see an example on how to determine your HS code.

Click here to see an example on how to read the HS.

Click here to see an example on how to read the HS.

Guidebook on the HS Classification of Chemicals & Chemical Products

This guidebook serves as an aid for users to classify chemicals and chemical products according to the HS Codes found in STCCED. It includes case studies and frequently asked questions on the classification of chemicals and chemical products.